You have heard me mention before about Bitcoin, the first "mainstream" cryptocurrency on the market. It is certainly on the rise even with several damaging incidents from viral attacks, accidental wallet theft to outright con scams. In general the community is very good, but one thing is certain Bitcoin seems to be fairly set in stone as it is. This is leading to the developments of new cryptocurrencies in an effort to solve perceived problems with Bitcoin or to apply very different economic models. One thing is for certain, fiat currency as the primary currency has its days numbered.

Enter Solidcoin, this currency seeks to address some of the flaws to adoption of cryptocurrency including some native enhanced security features, faster coin processing time and faster growth rate to the maximum currency total. This currency will be very interesting to watch grow and to see how the economic model they have envisioned is realized.

Faster processing time seems to be the greatest benefit of Solidcoin over Bitcoin, in that with Bitcoin you could see situations where it may take several minutes and even hours to receive enough network confirmations for a transaction to be processed, this is clearly not ideal for point of sale systems or typical retail outlets. To develop the general cryptocurrency economy retail operations must be brought on board. Solidcoin can see confirmations start within three minutes (as opposed to Bitcoin's 10 minute processing time) and to receive the recommended 6 or more it can be done easily within half an hour. A retail store with some processing power to back their operation could easily shorten the time, as well as the possibility of adding features being developed by Bitcoin users such as "Green Addresses" which are representative of client systems (Think Banks, Credit Card Companies, etc.) the transaction times in Solidcoin could be literally instantaneous.

The other advantage relating to processing time is that Solidcoin has done away with optional and variable transaction fees that Bitcoin allowed for. The Solidcoin model instead opted for a mandatory minimal transaction fee, the reason this is an advantage is two fold. First, the network does not prioritize your transaction based on the fee you attached, in some cases Bitcoin users had seen their transactions with insufficient confirmation even after many hours when they entered very low or no fee. Secondly, many Bitcoin clients had built in mechanisms to enforce a variable transaction fee based on the details of your particular transaction, this is never ideal for a retail-consumer relationship because either party does not know what they are going to get. In the Solidcoin system you will always know what transaction fee you will pay so there will be no mystery. P.S. Transaction fees are good, they are what will keep decentralized cryptocurrrencies in operation by supporting the people donating their electricity and computing power to process and verify your transaction 24x7 365 days a year.

I will be talking more on Solidcoin in the future as we see it mature and gain stability but for now go check it out for yourself, it is easy to setup and who knows, you might see the value of this and jump on board early... it would pay off in the long run!

garagEconomy

Tuesday, August 23, 2011

Friday, August 5, 2011

Economies to scale

"If the US Government was a family, they would be making $58,000 a year, they spend $75,000 a year, & are $327,000 in credit card debt. They are currently proposing BIG spending cuts to reduce their spending to $72,000 a year. These are the actual proportions of the federal budget & debt, reduced to a level that we can understand." - Dave Ramsey

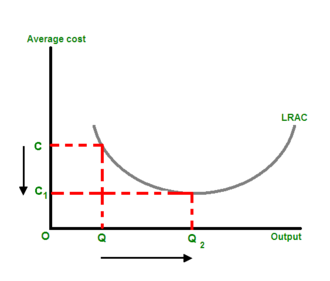

This got me thinking a little bit about economies of scale whereby as a company or organization expands it becomes more efficient to the product it offers. Here is a basic chart that describes the fundamental concepts behind it:

This relates to our governments as well, while this is a micro economic principle it applies when you look at the corporation or family as the government and in reality many corporations are serving more population than that of many governments so it's not really that much of a stretch. What I see is that most modern governments are creeping up the right side of the curve, this part of the curve relates to the entity that has squeezed out all or most competitors from the market place and is now approaching monopoly status. The interesting thing is that this is easy to prove, Governments are inherently a monopoly by the purest definition of the word. Therefore as government grows and expands its product (regulation, entitlements, etc.) it will become more costly to its consumers (tax and tariff paying citizens). This alone is a great argument for reducing government size and scope in all things. The cost inefficiencies arise from several factors, heightened bureaucratic oversight needed, inappropriate recipients of benefits due to the complexity of oversight and heightened demand for these services as more consumers are pushed into needing these services because they can no longer afford the cost. It is no wonder or surprise that governments world wide are facing massive deficit spending and exponentially increasing national debts.

The U.S. was a great experiment by the founding fathers, once a united nation of independent states, now a nation of states subjected to serfdom to the federal government. The same principle applies the the European Union, once a united economic alliance of independent European nations, now is a block of nations in servitude to the European Unions policies. I bring this up because whether it was planned intentionally or a great accident, the original founding fathers had erected a form of government in which competition among localized governments would be possible and joined in such a way that if one local government was failing its citizens the simplest solution is that the citizen could move to a more favorable local government and one that had failed beyond repair could fall and be rebuilt anew by its citizens not impacting the rest significantly.

People tend to not think of a government as a corporation, but lets take a step back. The government charges for its services; through taxes, tariffs, and inflation. It provides a product to its customers; via entitlement programs, bureaucratic oversight, national defense and national regulation. These basic parts would be the same as one would see in a corporation. The only difference is that a government mandates its product and mandates the cost, but this too is not much of a difference from corporations because any corporation that becomes large enough with a dependent customer base sees the same effects, this kind of corporation is commonly referred to as a monopoly.

Isn't it ironic that governments viciously regulate corporate monopolies but choose to not restrain their selves?

This got me thinking a little bit about economies of scale whereby as a company or organization expands it becomes more efficient to the product it offers. Here is a basic chart that describes the fundamental concepts behind it:

This relates to our governments as well, while this is a micro economic principle it applies when you look at the corporation or family as the government and in reality many corporations are serving more population than that of many governments so it's not really that much of a stretch. What I see is that most modern governments are creeping up the right side of the curve, this part of the curve relates to the entity that has squeezed out all or most competitors from the market place and is now approaching monopoly status. The interesting thing is that this is easy to prove, Governments are inherently a monopoly by the purest definition of the word. Therefore as government grows and expands its product (regulation, entitlements, etc.) it will become more costly to its consumers (tax and tariff paying citizens). This alone is a great argument for reducing government size and scope in all things. The cost inefficiencies arise from several factors, heightened bureaucratic oversight needed, inappropriate recipients of benefits due to the complexity of oversight and heightened demand for these services as more consumers are pushed into needing these services because they can no longer afford the cost. It is no wonder or surprise that governments world wide are facing massive deficit spending and exponentially increasing national debts.

The U.S. was a great experiment by the founding fathers, once a united nation of independent states, now a nation of states subjected to serfdom to the federal government. The same principle applies the the European Union, once a united economic alliance of independent European nations, now is a block of nations in servitude to the European Unions policies. I bring this up because whether it was planned intentionally or a great accident, the original founding fathers had erected a form of government in which competition among localized governments would be possible and joined in such a way that if one local government was failing its citizens the simplest solution is that the citizen could move to a more favorable local government and one that had failed beyond repair could fall and be rebuilt anew by its citizens not impacting the rest significantly.

People tend to not think of a government as a corporation, but lets take a step back. The government charges for its services; through taxes, tariffs, and inflation. It provides a product to its customers; via entitlement programs, bureaucratic oversight, national defense and national regulation. These basic parts would be the same as one would see in a corporation. The only difference is that a government mandates its product and mandates the cost, but this too is not much of a difference from corporations because any corporation that becomes large enough with a dependent customer base sees the same effects, this kind of corporation is commonly referred to as a monopoly.

Isn't it ironic that governments viciously regulate corporate monopolies but choose to not restrain their selves?

Thursday, August 4, 2011

My Facebook rant...

another sound voice above the deception and smoke 'n' mirrors games of politicians.... I can't believe notably this part:

"Regarding the debt directly, if they do not agree on what should be cut by November 23, 2011, the cuts will be distributed as the President sees fit. In addition, any congressman who votes AGAINST this bill is INELIGIBLE to serve on this mind-blowingly unconstitutional Super Congress." -- quote from -- http://rikelive.wordpress.com/2011/08/02/dollar-is-toast-super-congress-fries-constitution/

So they are keeping the most fiscally minded individuals in Washington from having a voice on the committee to "reign in deficit spending" (read tongue in cheek sarcasm). This is the most absolutely stupid thing I have heard since the idea that a no name senator from Chicago could be elected to office on nothing more substantial than promises of change and fear mongering that if you don't support his communistic socialist ideals (ala. Romney/Obama Care) then you're a racist.... oh wait that did happen, would make for a good movie one day, I would place it right next to my copy of "Idiocracy" in the comedy section... too bad we are living it.

On the not-so "Super" Congress/Committee --

"Regarding the debt directly, if they do not agree on what should be cut by November 23, 2011, the cuts will be distributed as the President sees fit. In addition, any congressman who votes AGAINST this bill is INELIGIBLE to serve on this mind-blowingly unconstitutional Super Congress." -- quote from -- http://rikelive.wordpress.com/2011/08/02/dollar-is-toast-super-congress-fries-constitution/

So they are keeping the most fiscally minded individuals in Washington from having a voice on the committee to "reign in deficit spending" (read tongue in cheek sarcasm). This is the most absolutely stupid thing I have heard since the idea that a no name senator from Chicago could be elected to office on nothing more substantial than promises of change and fear mongering that if you don't support his communistic socialist ideals (ala. Romney/Obama Care) then you're a racist.... oh wait that did happen, would make for a good movie one day, I would place it right next to my copy of "Idiocracy" in the comedy section... too bad we are living it.

On the not-so "Super" Congress/Committee --

Tuesday, August 2, 2011

The effects of late receivers of new currency

For my first book review I will do on this site, I plan on doing the review on "What Has Government Done To Our Money?" by Murray N. Rothbard. However, a particularly crucial paragraph (see below) covers the topic I want to discuss today and that is inflation and it's effect on people.

This is the great deception that government chooses to not shed light on to the citizens of it's nation. In our typical economy the first receivers of money are the creators of that currency itself which is the government (and in the illegal sense, the counterfeiters; really though government issuance of new currency is just legalized counterfeiting often times not even backed by real notes of value, just as Banks create money from nothing through loans in our current system). As before mentioned the basic effects of inflation are obvious, you pay more for milk and eggs in the store.... what this excerpt mentions is the lag time of inflation, meaning this new currency gets spent at the value as if it had not been inflated at all, it is later when the economy has responded to this inflation of the currency where the new currency is traded for what it is really worth. And as Mr. Rothbard points out, this will typically be those on fixed incomes and the least capable to handle the effects of inflation. The big reason for this is the contracts which are signed in agreement before the inflation has taken place, for instance social security; *tongue in cheek* the great social program of our lifetime; the rates you pay into and receive were based on the value of the currency at the time you entered the program, the only concession is that pay-out is based on your income closer to when you are eligible for receipt of the benefit so if your pay beat the rate of inflation then you are doing better than most. The other people mentioned can be in an even worse scenario, ministers at most churches earn a fairly low income sadly, typically based on the tithing of their congregations and other services they can provide. So when they are tithed with a bank note that is viewed as being valued as being able to purchase a dozen eggs, they must hold the money to cover the church expenses and at the end of their budget cycle (say monthly) they get a share to live on which now that dollar is valued at only being able to buy 10 eggs.

The article implies that the receipts of debt payments suffer this as well but note it does not mention banks, the reason is that banks as previously discussed are in fact loaning non-existent currency in the first place, any return is a benefit to them. But on the flip-side he does mention credit repayment such as bonds, lease holders and the recipient of annuities, because these items of value backed and was loaned based on the value of the currency at time of lending. In most cases these are fixed for their life so if the set rate of growth (if any) does not match the rate of inflation then every year after the credit was generated the lender/landlord is loosing a little more of the buying power of their initial investment. How could the Bond market exist in this environment is simply a matter that they do their best to set an interest rate that will meet or exceed the rate of inflation but it is a for sure gamble and risk that this security faces. Long term leases often times will suffer the worst with this because in many situations they are not negotiated to raise rental rates based on inflation. Other companies have unique situations as well, my wife's company works with auto-parts distribution, sales and purchasing. By the mere inflation of the Dollar versus the Yen her company has become unprofitable, since the dollar is dropping in value (inflation at work), they are committed to contracts for the purchase and sale of parts internationally that although the parts are numerically trading at the same rate the bottom line of the company has fallen significantly since more Dollars are needed in purchases from those parts being made in foreign markets. Proponents of Job growth in the U.S. might see that as a good thing since her company now has a major effort to find local parts suppliers, but what they are finding is that the local suppliers are going out of business or not wanting to take on the risk of modernizing their factories to supply the parts at the right price and quality as needed in the automotive industry. They are stuck between a rock and a hard place that if not solved will mean job losses locally and an increase in automotive costs as fewer supplier options are available to automotive manufacturers.

What things can be done to deal with the issues relating to the late receivers of new currency?

"Inflation, then, confers no general social benefit; instead, it redistributes the wealth in favor of the first-comers and at the expense of the laggards in the race. And inflation is, in effect, a race—to see who can get the new money earliest. The latecomers—the ones stuck with the loss—are often called the 'fixed income groups.' Ministers, teachers, people on salaries, lag notoriously behind other groups in acquiring the new money. Particular sufferers will be those depending on fixed money contracts— contracts made in the days before the inflationary rise in prices. Life insurance beneficiaries and annuitants, retired persons living off pensions, landlords with long term leases, bondholders and other creditors, those holding cash, all will bear the brunt of the inflation. They will be the ones who are 'taxed.'"

This is the great deception that government chooses to not shed light on to the citizens of it's nation. In our typical economy the first receivers of money are the creators of that currency itself which is the government (and in the illegal sense, the counterfeiters; really though government issuance of new currency is just legalized counterfeiting often times not even backed by real notes of value, just as Banks create money from nothing through loans in our current system). As before mentioned the basic effects of inflation are obvious, you pay more for milk and eggs in the store.... what this excerpt mentions is the lag time of inflation, meaning this new currency gets spent at the value as if it had not been inflated at all, it is later when the economy has responded to this inflation of the currency where the new currency is traded for what it is really worth. And as Mr. Rothbard points out, this will typically be those on fixed incomes and the least capable to handle the effects of inflation. The big reason for this is the contracts which are signed in agreement before the inflation has taken place, for instance social security; *tongue in cheek* the great social program of our lifetime; the rates you pay into and receive were based on the value of the currency at the time you entered the program, the only concession is that pay-out is based on your income closer to when you are eligible for receipt of the benefit so if your pay beat the rate of inflation then you are doing better than most. The other people mentioned can be in an even worse scenario, ministers at most churches earn a fairly low income sadly, typically based on the tithing of their congregations and other services they can provide. So when they are tithed with a bank note that is viewed as being valued as being able to purchase a dozen eggs, they must hold the money to cover the church expenses and at the end of their budget cycle (say monthly) they get a share to live on which now that dollar is valued at only being able to buy 10 eggs.

The article implies that the receipts of debt payments suffer this as well but note it does not mention banks, the reason is that banks as previously discussed are in fact loaning non-existent currency in the first place, any return is a benefit to them. But on the flip-side he does mention credit repayment such as bonds, lease holders and the recipient of annuities, because these items of value backed and was loaned based on the value of the currency at time of lending. In most cases these are fixed for their life so if the set rate of growth (if any) does not match the rate of inflation then every year after the credit was generated the lender/landlord is loosing a little more of the buying power of their initial investment. How could the Bond market exist in this environment is simply a matter that they do their best to set an interest rate that will meet or exceed the rate of inflation but it is a for sure gamble and risk that this security faces. Long term leases often times will suffer the worst with this because in many situations they are not negotiated to raise rental rates based on inflation. Other companies have unique situations as well, my wife's company works with auto-parts distribution, sales and purchasing. By the mere inflation of the Dollar versus the Yen her company has become unprofitable, since the dollar is dropping in value (inflation at work), they are committed to contracts for the purchase and sale of parts internationally that although the parts are numerically trading at the same rate the bottom line of the company has fallen significantly since more Dollars are needed in purchases from those parts being made in foreign markets. Proponents of Job growth in the U.S. might see that as a good thing since her company now has a major effort to find local parts suppliers, but what they are finding is that the local suppliers are going out of business or not wanting to take on the risk of modernizing their factories to supply the parts at the right price and quality as needed in the automotive industry. They are stuck between a rock and a hard place that if not solved will mean job losses locally and an increase in automotive costs as fewer supplier options are available to automotive manufacturers.

What things can be done to deal with the issues relating to the late receivers of new currency?

Monday, August 1, 2011

A sound voice about the Debt debacle.

Because I think this hits at the heart of economic concern in the U.S. I feel obligated to share with any readers willing to work toward a better tomorrow! -James

August 1, 2011

ALEXANDRIA, Virginia - Today, 2012 Republican presidential candidate Ron Paul issued a statement outlining his opposition to the debt ceiling deal struck between the White House and Congress. See statement below.

"While it is good to see serious debate about our debt crisis, I cannot support the reported deal on raising the nation's debt ceiling. I have never voted to raise the debt ceiling, and I never will.

"This deal will reportedly cut spending by only slightly over $900 billion over 10 years. But we will have a $1.6 trillion deficit after this year alone, meaning those meager cuts will do nothing to solve our unsustainable spending problem.

"In fact, this bill will never balance the budget. Instead, it will add untold trillions of dollars to our deficit. This also assumes the cuts are real cuts and not the same old Washington smoke and mirrors game of spending less than originally projected so you can claim the difference as a ‘cut.'

"The plan also calls for the formation of a deficit commission, which will accomplish nothing outside of providing Congress and the White House with another way to abdicate responsibility.

"In my many years of public service, there have been commissions on everything from Social Security to energy policy, yet not one solution has been produced out of these commissions.

"By denying members the ability to offer amendments and only allowing an up-or-down vote that will take place in the hectic time between Thanksgiving and Christmas, this Commission essentially disenfranchises the vast majority of members from meaningfully participating in the debate over reducing spending and balancing the budget.

"Furthermore, despite the claims of the bill's proponents, there is nothing to stop the commission from recommending tax increases.

"One of the reasons why I humbly suggest that I am the most qualified Presidential candidate is my experience to see and understand the long track record of failure, disappointments, and bad recommendations made by such commissions.

"Times like these require statesmanship and steady leadership, which I and the grassroots activists who have joined my campaign believe I am uniquely qualified to provide.

"What should bother Americans most is that under cover of this debt ceiling circus, we learned from a recent GAO one-time, limited audit that the Federal Reserve secretly pumped $16 trillion into American and foreign banks over three years. All of the Fed's fat cat cronies were taken care of at the expense of the American public.

"To put that into perspective, our entire national debt is $14.5 trillion, and our annual deficit will be about $1.6 trillion, meaning the Federal Reserve created and appropriated more than our entire national debt to banks around the world in a few short years. We have been fighting in Congress these past few weeks over raising our debt ceiling by $2 trillion, an amount the Fed secretly gave away to just one big bank.

"For decades, politicians have promised future restraint in exchange for hikes in the debt limit. We are always told that we must act immediately to avoid a crisis. But time and time again, politicians reveal themselves to be untrustworthy, and we soon find ourselves in a crisis being led by the same folks who wish only to maintain the status quo.

"I believe in the great American traditions of free markets, sound money, and personal Liberty. But we are moving far away from what made us the greatest nation in human history. We must cut spending and balance our budget now, before it is too late.

"Let me be clear. The cuts we must make will not be easy, and there will be difficult times in the short run. But I have the greatest confidence that if we come together as a People, work hard, and do the right things, our country will be back on track in no time and on its way to unprecedented prosperity. But, if we continue to print money and pyramid debt, we will destroy ourselves and lose the promise of America forever.

"These difficult times require a President willing to stand against runaway spending. If elected, I will veto any spending bill that contributes to an unbalanced budget, and I will balance the budget in the first year of my term. I will not allow the Federal Reserve to destroy the value of our money by shoveling dollars into the pockets of its banker friends.

"I remain committed to working on behalf of the American people to drastically reduce spending and implement fundamental changes that will reform government and restore our nation's prosperity."

August 1, 2011

ALEXANDRIA, Virginia - Today, 2012 Republican presidential candidate Ron Paul issued a statement outlining his opposition to the debt ceiling deal struck between the White House and Congress. See statement below.

"While it is good to see serious debate about our debt crisis, I cannot support the reported deal on raising the nation's debt ceiling. I have never voted to raise the debt ceiling, and I never will.

"This deal will reportedly cut spending by only slightly over $900 billion over 10 years. But we will have a $1.6 trillion deficit after this year alone, meaning those meager cuts will do nothing to solve our unsustainable spending problem.

"In fact, this bill will never balance the budget. Instead, it will add untold trillions of dollars to our deficit. This also assumes the cuts are real cuts and not the same old Washington smoke and mirrors game of spending less than originally projected so you can claim the difference as a ‘cut.'

"The plan also calls for the formation of a deficit commission, which will accomplish nothing outside of providing Congress and the White House with another way to abdicate responsibility.

"In my many years of public service, there have been commissions on everything from Social Security to energy policy, yet not one solution has been produced out of these commissions.

"By denying members the ability to offer amendments and only allowing an up-or-down vote that will take place in the hectic time between Thanksgiving and Christmas, this Commission essentially disenfranchises the vast majority of members from meaningfully participating in the debate over reducing spending and balancing the budget.

"Furthermore, despite the claims of the bill's proponents, there is nothing to stop the commission from recommending tax increases.

"One of the reasons why I humbly suggest that I am the most qualified Presidential candidate is my experience to see and understand the long track record of failure, disappointments, and bad recommendations made by such commissions.

"Times like these require statesmanship and steady leadership, which I and the grassroots activists who have joined my campaign believe I am uniquely qualified to provide.

"What should bother Americans most is that under cover of this debt ceiling circus, we learned from a recent GAO one-time, limited audit that the Federal Reserve secretly pumped $16 trillion into American and foreign banks over three years. All of the Fed's fat cat cronies were taken care of at the expense of the American public.

"To put that into perspective, our entire national debt is $14.5 trillion, and our annual deficit will be about $1.6 trillion, meaning the Federal Reserve created and appropriated more than our entire national debt to banks around the world in a few short years. We have been fighting in Congress these past few weeks over raising our debt ceiling by $2 trillion, an amount the Fed secretly gave away to just one big bank.

"For decades, politicians have promised future restraint in exchange for hikes in the debt limit. We are always told that we must act immediately to avoid a crisis. But time and time again, politicians reveal themselves to be untrustworthy, and we soon find ourselves in a crisis being led by the same folks who wish only to maintain the status quo.

"I believe in the great American traditions of free markets, sound money, and personal Liberty. But we are moving far away from what made us the greatest nation in human history. We must cut spending and balance our budget now, before it is too late.

"Let me be clear. The cuts we must make will not be easy, and there will be difficult times in the short run. But I have the greatest confidence that if we come together as a People, work hard, and do the right things, our country will be back on track in no time and on its way to unprecedented prosperity. But, if we continue to print money and pyramid debt, we will destroy ourselves and lose the promise of America forever.

"These difficult times require a President willing to stand against runaway spending. If elected, I will veto any spending bill that contributes to an unbalanced budget, and I will balance the budget in the first year of my term. I will not allow the Federal Reserve to destroy the value of our money by shoveling dollars into the pockets of its banker friends.

"I remain committed to working on behalf of the American people to drastically reduce spending and implement fundamental changes that will reform government and restore our nation's prosperity."

Friday, July 29, 2011

Emerging Market Places

Not necessarily a new concept but the rise in these kinds of services are certainly showing us that people are getting tired of the fees being charged by systems such as PayPal and Ebay. Sites which bring sellers and buyers together in direct trade. Examples of this include Craigslist and Zaarly, and essentially they work by a buyer or seller posting what they want or want to sell and allowing sellers or buyers contact them directly. They encourage local transactions so shipping is not usually necessary as well.

The rise in such services I believe point to major happenings in the economy, the reduced buying power of the Dollar, these sites are thriving on the fact that a person can acquire new or used goods at a significant reduction in cost as well as the ability to use all of your buying power on the good or service desired instead of having to spend on unwanted services, such as the use of pay pal and shipping expenses. In order for a consumer to stretch the power of their money they are cutting out the middle men and trying to connect directly to the suppliers of what they desire. The only real downside is the scam customers and sellers. As an example my wife and I put out a posting to rent a room or two, we don't need to do this but we have a large house for us and it would be a way to improve our ROI (Return on Investment) in our home. We chose to do this because we are in a unique marketplace where rent rates have jumped up dramatically to the point where buying a house has an unarguably reduced cost of ownership. We had 5 replies, and only 1 of them was legitimate. Fortunately the scams tend to be easy to spot. The key is to deal locally, directly, and in cash. Most of the scams involve wiring funds or with entities claiming to be from foreign countries and needing transactions through third parties.

Another re-emerging market place for the same reasons is the local farmer's markets and butchers, these markets often see higher quality and healthier goods at comparable if not better prices than most local grocers. The great advantages come from reduced transit costs, reduced/non-existent middle man mark-up costs and near to no expense in advertising costs. However, one loss in certain goods can be in government subsidies, which your taxes and national debts are paying for, and as we know the national debt is another indirect tax in that it reduces the spending power of the money you have. [I personally think it is better to loose the subsidies and go locally where possible because I can still get comparable prices, support local small and mid-size agriculture and I feel the subsidies are hurting the global population to begin with as they distort proper supply and demand... so I say opt out of the system when you can] Additionally, to offset expenses and stretch the money consumers have I see more and more people turning to growing small back yard gardens as well. My neighbor has a small orchard even, instead of growing greenery trees they decided to have pear trees and the like, my grandfather for years has grown a garden in his yard and even sells some of his crops in their local farmer's market. In these cases the goal was not to become 100% self-sufficient, but to augment their food usage with higher quality and lower costing food. A close knit community could even put specialization to use, a neighbor grows tomatoes and another potatoes and they trade a portion of each among themselves.

The final reason and quite possible the most significant that is encouraging people to do this is an unconscious decision to cut ties with the global market place, the cost of shipping alone is making that market place more and more unattractive every day. While it is possible to get cheaper labor in developing nations around the world to meet the demand for the goods that you might find in the emerging market places above it is heavily burdened by the shipping services and fuel costs which they pay to move the goods here. In the end what you need to do is go and compare a little on what there is to offer, some keys to look for are what goods are grown and manufactured locally and naturally (if you don't live in a tropical state and a local farmer is selling pineapple... you'll probably be paying a premium since it would need heavy use of green houses and extra watering for example) and try to develop a personal relationship with them... a local merchant is MUCH more likely to barter or negotiate prices with you than the mega store especially if you are on a first name basis with them and often they could provide insight on how to do some things yourself if you choose to do that.... my parents even got a great recipe for spaghetti that uses spaghetti squash instead of noodles from one of their local farmer's market merchants... it was really good!

What kind of experiences have you had with local market transactions?

The rise in such services I believe point to major happenings in the economy, the reduced buying power of the Dollar, these sites are thriving on the fact that a person can acquire new or used goods at a significant reduction in cost as well as the ability to use all of your buying power on the good or service desired instead of having to spend on unwanted services, such as the use of pay pal and shipping expenses. In order for a consumer to stretch the power of their money they are cutting out the middle men and trying to connect directly to the suppliers of what they desire. The only real downside is the scam customers and sellers. As an example my wife and I put out a posting to rent a room or two, we don't need to do this but we have a large house for us and it would be a way to improve our ROI (Return on Investment) in our home. We chose to do this because we are in a unique marketplace where rent rates have jumped up dramatically to the point where buying a house has an unarguably reduced cost of ownership. We had 5 replies, and only 1 of them was legitimate. Fortunately the scams tend to be easy to spot. The key is to deal locally, directly, and in cash. Most of the scams involve wiring funds or with entities claiming to be from foreign countries and needing transactions through third parties.

Another re-emerging market place for the same reasons is the local farmer's markets and butchers, these markets often see higher quality and healthier goods at comparable if not better prices than most local grocers. The great advantages come from reduced transit costs, reduced/non-existent middle man mark-up costs and near to no expense in advertising costs. However, one loss in certain goods can be in government subsidies, which your taxes and national debts are paying for, and as we know the national debt is another indirect tax in that it reduces the spending power of the money you have. [I personally think it is better to loose the subsidies and go locally where possible because I can still get comparable prices, support local small and mid-size agriculture and I feel the subsidies are hurting the global population to begin with as they distort proper supply and demand... so I say opt out of the system when you can] Additionally, to offset expenses and stretch the money consumers have I see more and more people turning to growing small back yard gardens as well. My neighbor has a small orchard even, instead of growing greenery trees they decided to have pear trees and the like, my grandfather for years has grown a garden in his yard and even sells some of his crops in their local farmer's market. In these cases the goal was not to become 100% self-sufficient, but to augment their food usage with higher quality and lower costing food. A close knit community could even put specialization to use, a neighbor grows tomatoes and another potatoes and they trade a portion of each among themselves.

The final reason and quite possible the most significant that is encouraging people to do this is an unconscious decision to cut ties with the global market place, the cost of shipping alone is making that market place more and more unattractive every day. While it is possible to get cheaper labor in developing nations around the world to meet the demand for the goods that you might find in the emerging market places above it is heavily burdened by the shipping services and fuel costs which they pay to move the goods here. In the end what you need to do is go and compare a little on what there is to offer, some keys to look for are what goods are grown and manufactured locally and naturally (if you don't live in a tropical state and a local farmer is selling pineapple... you'll probably be paying a premium since it would need heavy use of green houses and extra watering for example) and try to develop a personal relationship with them... a local merchant is MUCH more likely to barter or negotiate prices with you than the mega store especially if you are on a first name basis with them and often they could provide insight on how to do some things yourself if you choose to do that.... my parents even got a great recipe for spaghetti that uses spaghetti squash instead of noodles from one of their local farmer's market merchants... it was really good!

What kind of experiences have you had with local market transactions?

Thursday, July 28, 2011

Alternative Currency

Currency I would argue has been one of the most fought over entity in all history. Civil Wars are fought (English civil war was in large part taxes and fees being charged), empires have crumbled (notably the Roman empire), and Revolutions are started (American, in part over taxation and the French for debasing their currency supporting the American Revolution... now that is a little irony...). Or more pertinent these were fought over improper mismanagement of currency by the governments in place. Since currency almost by natural law is required for a high level civilization to operate and it is the easiest piece of the economy for a government to control it therefore has become almost universally abused in every country and caused the most frustration of their citizens.

Technology has increased, in use and capability, to the point where alternative currencies can be put into place which by their nature a government or any single entity can control meddle in them directly. I believe this to be a good thing and it map help usher in a greater world peace possibly greater than even that attributed to the nuclear bomb. The biggest hurdle being looked at is what economics rules need to be put in place for such currencies to do this, with the two most outspoken schools of thought and argument coming from Austrian vs. Keynesian economics. Another common denominator to the rise in these projects is a seemingly global increase plight of citizens to reclaim civil liberties that in many countries gradually being stripped from the people. Two notable examples would be Ripple and BitCoin. Ripple directly being an exchange of debts between individuals and BitCoin being an exchange of digital currency that in and of itself is intended to have value and properties similar to gold and silver. I point those out because it would seem that they are increasing in visibility and use more than most. What is even more unique in these systems is that they are revolutionizing a major principle of one of the major parts of money which is intrinsic value, no digital currency can be directly turned into a good or service, the same is true of fiat currency however fiat currency was an evolution from money which did have intrinsic value. I would argue however this is really just an evolution of fiat currency, and this can easily be seen by how people currently view those currencies. Ripple is a measure of debt based on an external system of value (typically fiat currency) and BitCoin is not measured by it's value against goods and services but it's value against fiat currency. The early merchant adopters of these systems have typically been in the form of service offerings which is a sign that even at their current level of risk people are willing to trade time more than actual physical goods for these currencies in both systems however the trade of goods does occur but the adoption seems to be slower and even then it is more based on the value in fiat currency they can get from these and not the value of the currency itself so a premium is often charged due to the need for use of a currency exchange. In any decentralized alternative currency this will be the case.

The biggest shortcomings limiting adoption of these currencies is government policy, for instance taxes, by law in the U.S. you must pay your taxes in U.S. Dollars so to use any alternative currency you must exchange it and perform accounting in U.S. Dollars and not an alternative currency. China has very strict currency control laws and any use of an alternative competing currency is outright illegal. What this leads to is an interesting phenomena, the earliest adopters for use as an exchange for actual goods of value will be Black Market trading. With the crack down on online gambling in the U.S. there were online casinos which started accepting alternative currencies and merchants who openly trade contraband goods for it as well. This is due to the anonymity of the currency transaction itself which is a necessary feature of any decentralized currency. With a little research of my own I discovered you could also trade foreign currency at much more favorable rates than the current mainstream forex markets... for instance the Chinese renminbi trades a little more favorably against the U.S. Dollar than it does on the forex markets and there are much lower fees in the processing than would be charged by centralized financial organizations. I believe it is these things which will spurn a backlash by governments and ironically solidify their legitimacy as a fair and valid form of currency since they would need to be treated as such in order to create legislation against them. Ultimately however once any alternative currency gets to the point where there is widespread adoption and merchants begin to shift to trading alternative currency directly and not their worth vs. fiat currency will be the golden moment when they have a very strong chance to outright replace traditional fiat currency. Of course it would be nice if government helped speed the process along and allow people to buy government services and pay taxes in an alternative currency but that is unlikely as it is giving up one of their primary means of control on their citizens and economy, it will take mass adoption for this to happen.

What alternatives are out there? It is very interesting for sure. Here is another project in the works, the Terra, to help you in your research.

Subscribe to:

Posts (Atom)